The Bank of Canada Holds Rates Steady Even As the Fed Promises to Push Higher

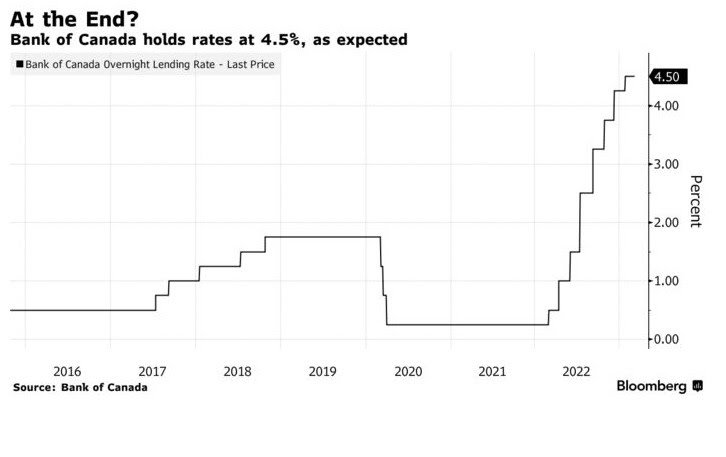

As expected, the central bank held the overnight rate at 4.5%, ending, for now, the eight consecutive rate increases over the past year. The Bank is also continuing its policy of quantitative tightening. This is the first pause among major central banks.

Economic growth ground to a halt in the fourth quarter of 2022, lower than the Bank projected. 'With consumption, government spending and net exports all increasing, the weaker-than-expected GDP was largely because of a sizeable slowdown in inventory investment.' The surge in interest rates has markedly slowed housing activity. 'Restrictive monetary policy continues to weigh on household spending, and business investment has weakened alongside slowing domestic and foreign demand.'

In contrast, the labour market remains very tight. 'Employment growth has been surprisingly strong, the unemployment rate remains near historic lows, and job vacancies are elevated.' Wages continue to grow at 4%-to-5%, while productivity has declined.

'Inflation eased to 5.9% in January, reflecting lower price increases for energy, durable goods and some services. Price increases for food and shelter remain high, causing continued hardship for Canadians.' With weak economic growth for the next few quarters, the Bank of Canada expects pressure in product and labour markets to ease. The central bank believes this should moderate wage growth and increase competitive pressures, making it more difficult for businesses to pass on higher costs to consumers.

In sum, the statement suggests the Bank of Canada sees the economy evolving as expected in its January forecasts. 'Overall, the latest data remains in line with the Bank's expectation that CPI inflation will come down to around 3% in the middle of this year,' policymakers said.

However, year-over-year measures of core inflation ticked down to about 5%, and 3-month measures are around 3½%. Both will need to come down further, as will short-term inflation expectations, to return inflation to the 2% target.

Today's press release says, 'Governing Council will continue to assess economic developments and the impact of past interest rate increases and is prepared to increase the policy rate further if needed to return inflation to the 2% target. The Bank remains resolute in its commitment to restoring price stability for Canadians.'

Most economists believe the Bank of Canada will hold the overnight rate at 4.5% for the remainder of this year and begin cutting interest rates in 2024. A few even think that rate cuts will begin late this year.

In Congressional testimony yesterday and today, Federal Reserve Chair Jerome Powell said that the Fed might need to hike interest rates to higher levels and leave them there longer than the market expects. Today's news of the Bank of Canada pause triggered a further dip in the Canadian dollar (see charts below).

Fed officials next meet on March 21-22, when they will update quarterly economic forecasts. In December, they saw rates peaking around 5.1% this year. Investors upped their bets that the Fed could raise interest rates by 50 basis points when it gathers later this month instead of continuing the quarter-point pace from the previous meeting. They also saw the Fed taking rates higher, projecting that the Fed's policy benchmark will peak at around 5.6% this year.

Bottom Line

The widening divergence between the Bank of Canada and the Fed will trigger further declines in the Canadian dollar. This, in and of itself, raises the Canadian prices of commodities and imports from the US. This ups the ante for the Bank of Canada.

The Bank is scheduled to make its next announcement on the policy rate on April 12, just days before OSFI announces its next move to tighten mortgage-related regulations on federally supervised financial institutions.

To be sure, the Canadian economy is more interest-rate sensitive than the US. Nevertheless, as Powell said, “Inflation is coming down, but it’s very high. Some part of the high inflation that we are experiencing is very likely related to a very tight labour market.”

If that is true for the US, it is likely true for Canada. I do not expect any rate cuts in Canada this year, and the jury is still out on whether the peak policy rate this cycle will be 4.5%.